Instant investment through Video KYC

Lower customer acquisition cost through faster onboarding.

Refer the Product guides for the implementation details.

Simple 10 second video for investors

Instant KYC compliance check using PAN

Digital OVD collection through image uploads

Full KYC with no investment limits

Authentication of identity and address

Accept POI (PAN)

Accept POA (DL, Voter ID card and Passport)

In line with KYC and AML regulations

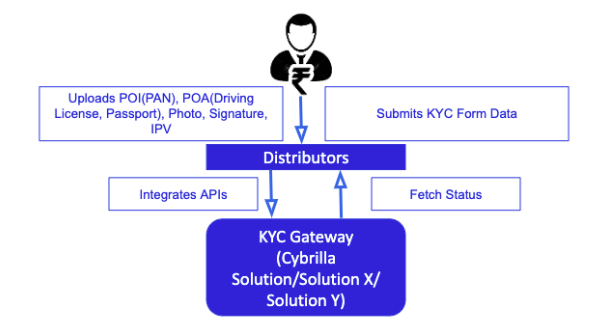

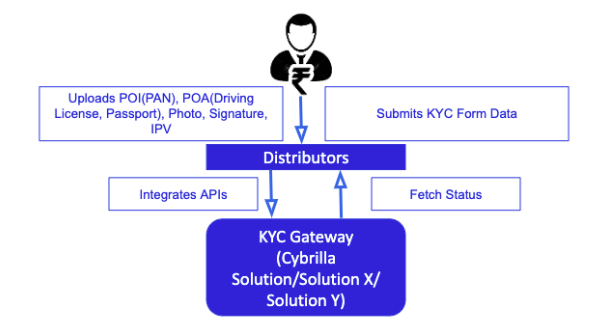

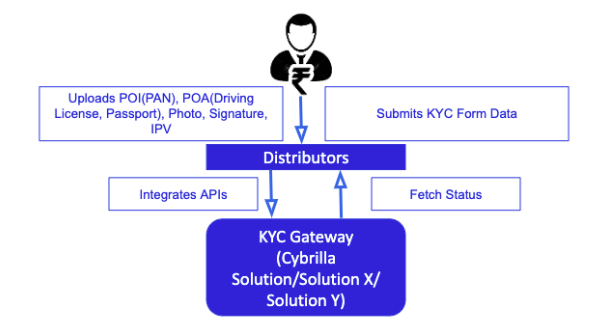

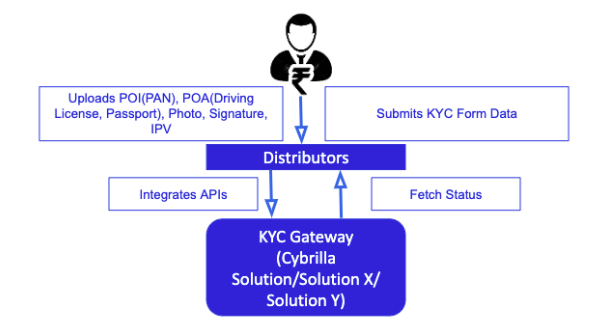

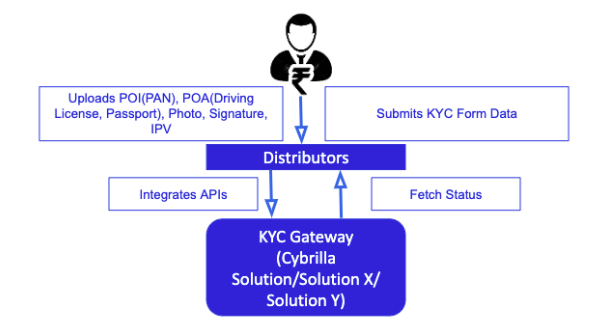

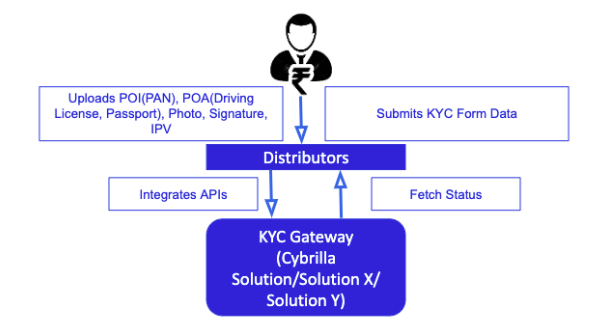

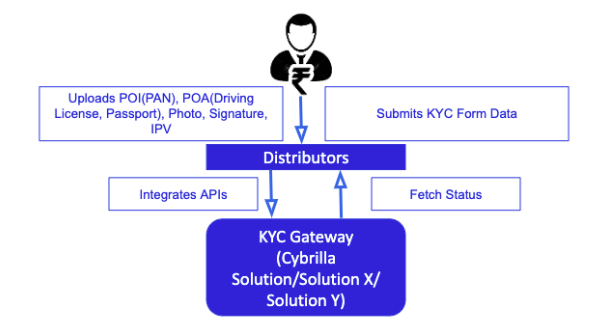

Flexibility to switch over to other partner integrations

Fully digital in person verification through partner

Control your user experience, while APIs handle the complexity

Zero Operations overhead for the distributor

Cost savings of 10 operations personnel

Seamlessly integrate with developer friendly APIs

You are losing leads because of traditional KYC solutions

| Features | Traditional MF Platforms | Fintech Primitives |

|---|---|---|

| Registration | Physical forms and signature required | 100% paperless |

| Account Opening Form | High rate of rejected transactions due to lack of AOF or wrong AOF | Automated investor registration with RTAs |

| CAN | Required for the offline era | 1 simple API to onboard users |

| Features | Traditional MF Platforms | Fintech Primitives |

|---|---|---|

| Video KYC enablement | Minimum investment of ₹ 5000 | Minimum investment of ₹ 100 |

| Video KYC integration | Not available (Redirection, with no control over experience) | 1 simple API, with full control over end user experience |

| Video KYC status | Not available | Easy status check |

| Cost | Anywhere between ₹ 500 - 3000 | Near zero costs |

| KYC type | Could be full or partial | Full KYC |

| First time KYC status check | Not available | 1 simple API for instant status check through PAN |

| Paperless KYC | Not available | 100% paperless Video KYC APIs |

| Flexibility to switch over to other KYC providers | Not available | Yes |

| Product Guides | Not available | Simple workflow guide to integrate the API |

| Features | Traditional MF Platforms | Fintech Primitives |

|---|---|---|

| Sandbox | Not available | Free to test and integrate all APIs. |

| Features | Traditional MF Platforms | Fintech Primitives |

|---|---|---|

| Technical queries | Anywhere between 3-15 days to reply back | Within 24 business hours |

| Integration support | Not available | Technical guidance from the product and engineering team |

| New use cases | Not available | Guidance from the product and engineering team |