You’ve been thinking about launching a fintech business and/or you have been thinking about launching financial use cases as a new product line within your existing business.

Let’s take the example of distribution of mutual funds. Now, you’re attempting to make a decision. About whether you should build your own mutual fund distribution from the ground up or utilize APIs to build the same.

As you may agree, building your own mutual fund distribution platform requires a significant investment of time, resources, deep clarity about your business goals and the nudge elements of your user experience. Depending on your mutual funds use case, people constraints and business priorities, you will evaluate various options and move forward with an implementation that makes the most sense for your needs.

Mutual fund case studies with Fintech Primitives

Let’s begin with costs, as it will impact every questionable comparison between building your mutual funds distribution infrastructure and buying API building blocks. Below are examples that talk numbers.

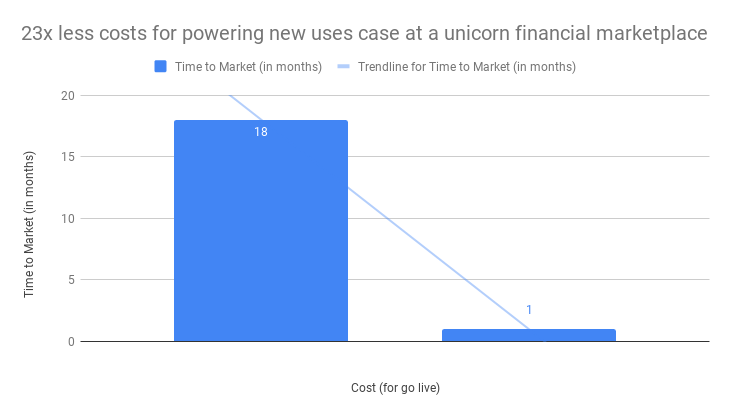

Total Cost of Ownership – A Billion $ financial marketplace

Fintech Primitives conducted a Total Cost of Ownership (TCO) comparison for one of India’s leading unicorn marketplaces (valued at more than a billion $) that wanted to rebuild and scale their existing mutual funds service for their end users.

Fintech Primitives estimated that the in-house development of building out the appropriate backend and then scaling it would be approx. $500K, maintenance and upgrade costs would be another $200K, and infrastructure cost would total $10000 annually.

This raises the total cost of building this in-house to nearly $700K, which would have been 23x more than what it would cost to offer mutual funds using Fintech Primitives APIs. More importantly, the above costs would be significantly heavy on upfront capex, without achieving any business goals (like acquiring new users, converting the users into making larger ticket transactions or retaining users through different use cases).

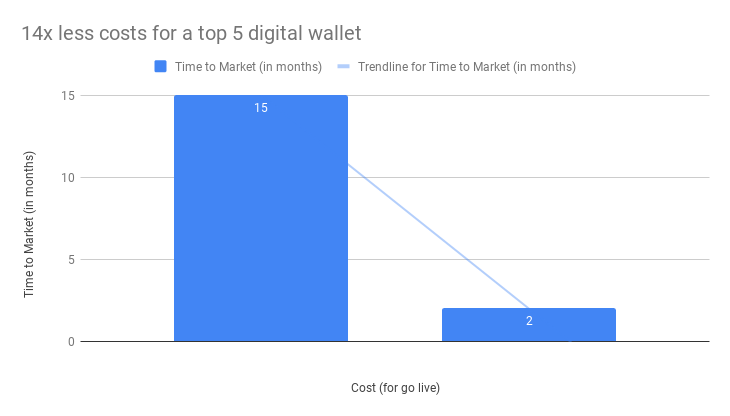

Total Cost of Ownership – A top 5 digital wallet

One of India’s leading e-wallets with massive 10 million downloads, was interested in launching financial products, beginning with the distribution of mutual funds. For kickstarting this offering, the costs of building it would be approx. $300K, maintenance and upgrade costs would be another $100K, and infrastructure cost could go up to $15000 annually.

Fintech Primitives costed at least 14x less than the inhouse estimates of nearly $500K. Additionally, being a big organisation; they would have to cross collaborate across multiple product teams, manage priorities among multiple requirements and, finally integrate across multiple systems, which would have taken them more than 18 months to go live.

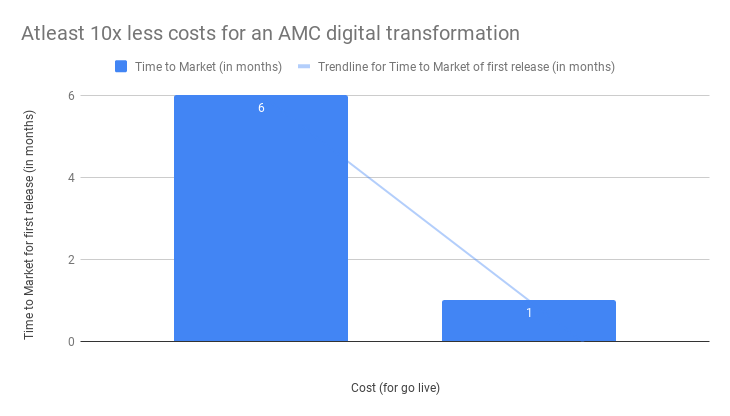

Total Cost of Ownership – Digital transformation for a large asset management company

We conducted another TCO comparison for a leading AMC. As part of their digital transformation efforts, the business and digital teams not only desired a complete rebuild of their existing systems. But also a lightening fast launch for their new fund offer (NFO). To rebuild the infrastructure for their next phase of growth, Fintech Primitives was atleast 10x more cost effective for the go-live, and 90% more effective for a complete user experience revamp compared to legacy distribution platforms. The first release of the investor and distributor applications for the NFO infact happened in 1 month, thanks to the easy to plug in API platform.

This example underlines something very important: that not only can time-to-market become faster, but the cost of quickly launching new use cases can also be much cheaper.

Notes –

- If costs are on an annual subscription basis vis a vis upfront heavy capex; it helps bring down the financial burden significantly.

- In the examples, we have not yet touched upon the platform / backend engineers that would have to be hired to build and maintain a scalable backend

Impulse to build

Having seen the above numbers, how do you evaluate the decision to build vs. buy?

Many technology companies insist on owning the entire backend development because it may feel antithetical to purchase functionality core to their business. Fintech Primitives understands this notion very well; as we too have felt the need to own engineering solutions.

However, we did like to begin suggesting that mutual funds transactions have been commoditised. An in-house backend that enables transactions is no longer a differentiating feature for either your end users, your teams, your management or your venture capital investors.

We are suggesting the above basis the following –

- Mass adoption of robo advisors (the growth numbers speak for themselves)

- Standardisation of the backend complexity (courtesy Fintech Primitives)

- Undeniable business benefit of accelerated time to market (from 18 months to 1 month)

- Difficulty of maintaining regulatory changes, protocols to communicate with legacy XML based systems, and scaling the backend infrastructure while launching new features

Consequently, it may not make sense to build the entire backend unless it really adds value to your users or your business or you can hire the team to maintain it.

Three perspectives to the decision

The decision to build or buy is crucial. Which is why we have detailed out three broad perspectives for the same –

- Cost

- Problem statement

- Risk

Perspective 1 – Cost

A key criterion for deciding how to implement distribution of mutual funds is to understand the capacity of your available technology team and to understand how much it will cost to build.

Building software in a domain that you’re not familiar with can lead to unknown challenges, high expenses, and can dampen the speed to market. Usually, building a basic mutual fund app will cost anywhere from $50k – $200k in developer costs alone, assuming a team of 8 – 12 experienced engineers working for 8-12 months.

If you’re a large business that wants to distribute mutual funds as a shared extensible service, then the need for resources amplifies because it would require your team to collaborate across multiple product teams, to manage priorities among multiple teams’ requirements and, finally, to integrate across multiple products. In other words, implementing mutual funds distribution for your company won’t happen in a vacuum, as in the estimate above, but, rather, it will cut across multiple teams and product roadmaps.

Other than development engineers, you should also account for costs for systems of development, for the server and infrastructure to build and run a service at high-scale, for maintenance & upkeep, and for ongoing variable costs to keep the service up-to-date for emerging customer needs / use cases.

Here’s the bottom-line – if you don’t have at least a few experienced fintech developers working on your project, you may want to think about getting APIs so you can build the use cases on top of it.

Perspective 2 – What is your problem statement?

The most important dimension to your decision is understanding your business goals. Leading mutual fund robo advisors offer fully digital KYC, a variety of transactions (lumpsum,sip, switch, stp, swp, etc), multiple reports (portfolio holdings, capital gains, CAS statements). They also provide advanced capabilities like risk profiling, goal based investments and custom recommendations for investors willing to take higher risks.

Mutual fund users, propelled by massive campaigns and adoption are slowly becoming sophisticated. And beginning to expect an experience similar to the leading fintech apps. You shall need to figure out if you are solving for first time investors, sophisticated investors or both? And through what use cases? Then there are tangential questions if your core business is not mutual funds. For example, you’ll need to deploy people (engineers, certified financial planners, etc) just to understand the domain and help differentiate your business in the market.

Is mutual funds distribution a product or a feature?

Many businesses imagine mutual funds distribution to be a simple buy and sell transaction, that can be added as a small feature to their suite of offerings. However, what they miss out is that distribution of financial products like mutual funds are an entire product with a feature bundle that has to be serviced via a highly-scalable backend infrastructure.

If you’re a large fintech serving users through multiple verticals, it would be worthwhile to revisit the presumption whether mutual funds is just a feature, or if you‘d like it to be a key offering helping to cross sell other fintech use cases.

Your backend team shall have to build the underlying microservices and/or SDKs as the backbone communication layer that can be used across multiple use cases. Are you ready to invest in building this layer from scratch?

Engineering teams also typically have a checklist of architectural requirements before they can begin implementation. Are you willing to consider, evaluate and decide on each of those pieces instead of focusing on your end users?

Perspective 3 – Risk

The third dimension is risk. Risk can come in multiple forms: business risk, time-to-market, scope, data, security and so on.

It’s essential that you are thinking about a few such questions:

- Is the platform built by an experienced team of product and engineering professionals? Has the team served any other key companies in the mutual funds/finance industry?

- Is the platform team focused on their own profit margins or on solving problems for you and your end users?

- Are the APIs friendly? That is, are they robust, RESTful based that any developer can begin using?

- Is the platform capable of handling large volumes?

- Does the platform have unnecessary costs?

- Does it provide me the flexibility to choose the building block you currently need for your business?

- How soon can you get started on using the APIs? Does it require some complex setup to be initiated for the technology team?

- How soon can you complete the integration with the APIs? Unlike large fintechs who took 18 months to go live, can you do it in less than 1 month?

- Do you have the flexibility to use your inhouse tech team? Can they use any programming language/technology stack?

- Can you build new use cases to delight your users?

- Can you show reports in any form you deem fit?

- Are you restricted by the platform or can you use your own creativity to come up with an awesome customer experience for my end users?

- Do you want to go-to-market with a basic experience or a delightful experience like the leading fintechs?

- Can you trust a 3rd party with storing data on their servers?

- What if you were to discover a bug in the service – how quickly would you be able to resolve it in-house vs having a partner team fix it without disrupting the customer experience?

You shall need answers to these questions to reduce your company’s risk; measured in different variables like time-to-market, security, or feature roadmap.

Fintech Primitives: The only platform with all API building blocks for mutual funds

With 9+ years of experience building various fintech apps from scratch; we bring in the experience of evaluating the cost, risks, problem statements and the benefits of integrating APIs into applications. Which is why we have chosen to solve the hard problem of building the API infrastructure that can power apps at scale.

If you’re a product manager, executive, technology decision maker, engineering manager, or a developer looking to build fintech use cases like mutual funds in your application, platforms like Fintech Primitives can help you kill two birds with one stone.

- With us, you can build and scale to millions of users, delighting them with engaging fintech experiences that they have come to expect from the top fintech apps.

- We offer you the deep product experience across different use cases, so you build the best product and customer experience.

Why it’s difficult to build mutual funds distribution from scratch?

We will dive in to understand why it’s particularly hard to build a mutual funds distribution offering from scratch.

All the integrations needed

We have deeply integrated with 50+ partner companies, to standardize the backend infrastructure. This has enabled us to offer a variety of APIs which abstract the underlying complexity and ensure that if a node in the journey fails, the APIs provide you with the appropriate reasons and TATs, so you don’t lose trust with your end users.

Time to Market

While a large fintech player took a sizeable 18 months to build the entire mutual funds backend infrastructure in house and go live, Fintech Primitives promises an integration time of less than a month. This has been possible because of the deep integrations with 50+ partners behind the scenes. This enables companies to launch and experiment faster. Eg – a lending company wanting to diversify its offerings can integrate the APIs in less than a month, run a pilot with 20% of their user base and scale the respective use case if it benefits their end users.

We care for your end users

Each API is designed by marrying B2C and B2B perspectives. All of this comes together to provide a true API only offering for mutual fund distributors and their end users.

Near zero costs

Running APIs at large volumes turns into an advantage, as the platform scales and continues to operate at low costs.

Fintech Primitives Team

Fintech use cases don’t automatically succeed. It’s difficult to build and scale, to produce the right user experience to encourage adoption – we know this because we have built the top robo advisors in the country.

We approach each distributor differently. Each conversation is aligned towards figuring out the building block that will help the customer move his/her needle – whether its scaling error free transactions, acquiring new users through video KYC, generating reports or saving transaction costs – and then go from there to help our customers implement the right building block.

Enabling new use cases

This comes straight from our customer,

“We believe APIs give us the flexibility to play around with our user experience, while we try different experiments. This allows us to stay closer to our users, as we continuously launch new features to amaze them, without worrying about running into compliance issues, scale issue or legacy system issues”

So, will you build or buy?

You can apply the information across the three different dimensions mentioned above to make a decision. A mutual funds API as a service is an option for teams that are looking for maximum product leverage (dev friendly APIs, flexibility, new use cases) and business leverage (time to market, near zero costs), along with compliance and reliability.

Irrespective of your decision, how you go about implementing distribution of mutual funds will directly correlate to your business KPIs.

References

- A decade of building the top robo advisors in India like Scripbox, Upstox, Paisabazaar, Clearfunds (acquired by Mobikwik) and more.

- The multiplicative power of APIs

- Learnings from powering different use cases for various companies

Product Mgmt & GTM Strategy.

Helping digitize financial infrastructure for wealth mgmt in India