What do APIs have in common with a math operation like multiplication? What does all of this have to do with distribution of financial products? Let’s talk about multiplication first.

Multiplication

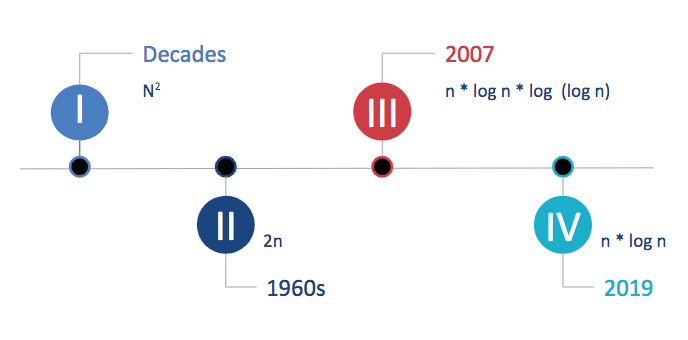

The typical method to multiply two two-digit numbers involves four smaller multiplications, followed by addition to produce a final product. This method of “carrying” requires approx n2 steps, where n is the number of digits of each of the numbers that are being multiplied. Eg – a three-digit number requires nine multiplications.

It is generally assumed that the basic method of “carrying” that has been around for decades is the best one. Complex computational problem statements like finding large prime numbers have been dependent on the speed of multiplication. If one wants to improve how fast computers can solve certain mathematical problems, then integer multiplication is the basic building block for achieving speed.

Building blocks

The carrying method works well for numbers with just a few digits, but it slows down drastically when multiplying numbers with millions or billions of digits. To multiply two numbers with 1 million digits requires 1 million squared, or 1012 multiplications, which would take a modern machine very long to compute. In a parallel financial universe, let’s take the example of mutual fund distribution. It has been assumed since long that the systems existing for decades don’t warrant any changes. These systems were designed for the offline era and worked well for the time. However, they get completely bogged down when it comes to launching new products in the digital era.

The new approach for multiplication proves that multiplication can be done in n × log n steps, instead of n2 steps. The method involves breaking up the digits of a number and recombining them so that it allows one to substitute a small number of additions and subtractions for a large number of multiplications. The method saves time because addition takes only 2n steps, as opposed to n2 steps. In the Indian financial universe, Fintech Primitives APIs have broken down each business process into granular services, which can be recombined into modules for building clean and simple user facing interfaces.

The objective for the new multiplication approach was to turn some of the multiplication steps into additions, and make it work faster. With Fintech Primitives, the objective has been to turn the large decade old systems into granular services that can be called as and when needed by business applications. Through APIs, new features / use cases can be released at increased velocity to users.

While integer multiplication is the building block of the computation universe, APIs like Fintech Primitives are the building blocks of the financial universe.

The multiplication effect on distribution of financial products

Through our experience of building and powering multiple fintech apps, we strongly believe that large scale adoption of financial products like mutual funds are an engineering problem statement, and not a financial problem statement. We continuously identify abstractions via building blocks (APIs) to enable standardised and scalable integrations. Since we remove the unnecessary steps, while making it easy to integrate; any developer can get up and running with Fintech Primitives in a matter of minutes. Armed with this power of multiplication, fintechs are using APIs to power various interesting use cases in less than 3 weeks! Another example is when two complex features to solve for customer activation and conversion for one of India’s largest AMC (asset management company), were built and launched on top of APIs within just 24 hours!

Martin Fürer, who in 2007 created what was at the time the fastest multiplication algorithm

“It was kind of a general consensus that multiplication is such an important basic operation that, just from an aesthetic point of view, such an important operation requires a nice complexity bound. “From general experience the mathematics of basic things at the end always turns out to be elegant”

The complexity of many computational problems boils down to the speed of multiplication. In the parallel universe of financial products, the complexity of distribution problems boils down to elegant APIs that multiply value by handling the underlying domain, technical and regulatory heavy lifting.

References

- The perfect way to multiply 2 integers – Link

- 10+ years of building the top robo advisors in India like Scripbox, Upstox, Paisabazaar, Clearfunds and more.

- Powering fintechs with a variety of new use cases

- Powering new age AMCs like Navi

- Enabling digital transformation of large AMC’s like Principal India

Product Mgmt & GTM Strategy.

Helping digitize financial infrastructure for wealth mgmt in India