With the recent release of The Matrix Resurrections, it’s only befitting to visit the questions & subsequent choices in an AMC’s digital transformation journey.

Asset management companies (AMCs) continuously strive towards improving the experience they offer in the purchase or sale of mutual fund (MF) units. These transactions could be investor initiated or partner initiated. When an AMC attempts digital transformation through the implementation of new digital experiences, it involves important decisions of where to start, then how to allocate budgets (marketing budget, analytics budget, UI/UX budget, etc) between competing qualifying use cases. How does one decide how much to commit and which use case to commit to, in order to better the overall experience? The decision is not simple because each use case will have slightly different investment vs payoff profiles. Taking a step back, digital use cases require an experimentation mentality, ie, to build, measure and scale the ones that work best. Hence, even before deciding on competing use cases, a critical decision is how does one reach a stage of enabling parallel use cases quickly in the first place?

Geometric or arithmetic mean?

For a product of n numbers, the geometric mean is the nth root of the product. The arithmetic mean is the sum of n numbers divided by n. For example, for the list of numbers {0.4, 1, 2, 3, 0.1}, the geometric mean is the 5th root of (0.4 x 1 x 2 x 3 x 0.1) or 0.75. For the same list, the arithmetic mean is (0.4 + 1 + 2 + 3 + 0.1) / 5 or 1.3. Note – even if 1 number is zero, the geometric mean becomes zero.

Superimposing the above into the digital MF universe, maximizing the arithmetic mean is appropriate when one is building one specific use case as a one time activity. Eg – an investor app or distributor app. However in the digital investment universe, one is by nature launching, executing & scaling use cases in parallel. The resultant payoffs from the right use cases compound over a duration, akin to investing. Therefore, an AMC needs to pick opportunities for converting and retaining users that would help maximize long-term stickiness over a long period of time. And there tend to be multiple such opportunities across independent interfaces & different use cases.

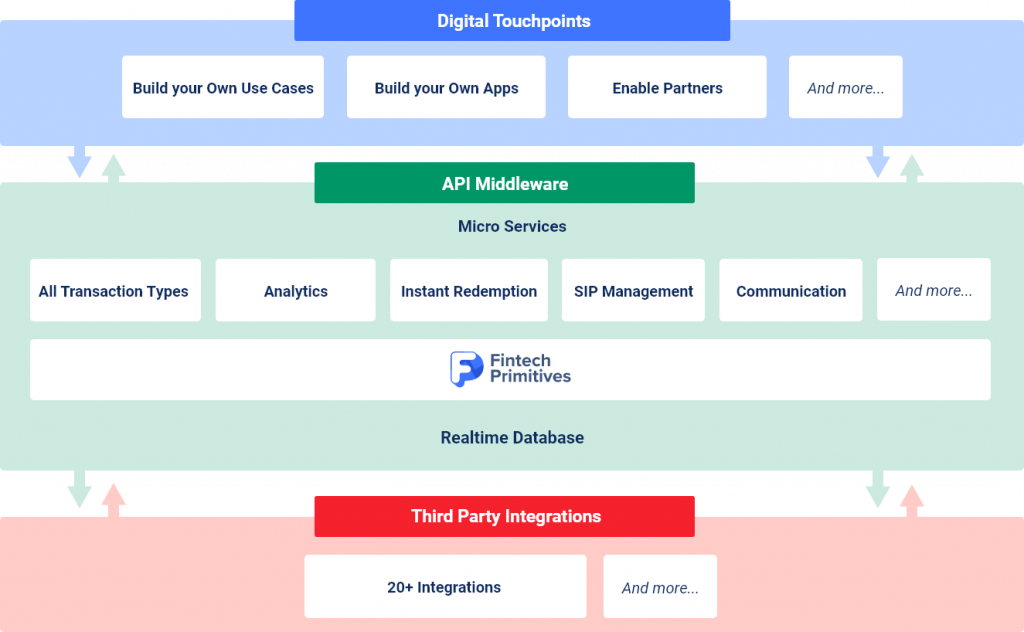

The appropriate goal for an AMC, then, is to firstly have a API middleware (standardized backend) that enables simple & quick launch of use cases. And then maximize the geometric mean of their portfolio of use cases. This is because the AMC must always have its best interfaces with the right use cases serve the right segment of users, while the core system (API middleware) auto runs & auto scales in the backend.

Why arithmetic mean leads to zero payoff?

Inspired by Wheel of Fortune, let’s spin a Wheel of digital fortune.

Key –

- Game = AMC digital transformation

- Wheel = Existing approach of hygiene apps delivered by different IT vendors, as & when required; basis cost & effort

- Other spaces on the wheel = Various digital activities by an AMC

The wheel has seven spaces marked “₹100” and one space marked “App delivered by an IT vendor.” While the arithmetic mean of this wheel is ₹700 / 8, or ₹87.5, the geometric mean is ₹0 due to the presence of the “App delivered by an IT vendor” space. In investing, this would be equivalent to a payoff = ₹0 scenario, which we are going to refer here as the “failed” space. A traditional IT services vendor delivering a project without deep domain knowledge is not going to move the needle around for investor conversion or retention metrics, or partner engagement metrics. Additionally, it is not going to arm the AMC’s stakeholders with insights; that could help drive decisions towards a better user experience. It would be fine if an AMC is comfortable to play such an IT project delivery game with a part of their budgets and time, as a one time activity. However, if one plays this game with their entire digital budget, they are bound to fail with 100% certainty in the long run, as one of the key scenarios will always have a payoff of zero.

Is the arithmetic mean / zero payoff avoidable?

In this example, the wheel of digital fortune represents the following –

- Game = AMC digital transformation

- Wheel = API middleware (standardized backend) by a strategic partner; with strong domain & tech chops

- Each space on the wheel = widgets / interfaces / use cases enabled by API middleware

The wheel has five spaces marked as ₹500 interfaces (web/mobile/etc). And four spaces marked as ₹100 use cases. Since the core system (API middleware) is a one time scalable system, the ability to build apps & launch use cases on top of the same becomes simpler. In this case, a couple of use cases may not deliver the expected payoff. However, the payoff will never go to zero. The arithmetic mean will be ₹100 and the geometric mean would be ₹244. While the second wheel will underperform the first wheel on most spins, it turns out to be the rational choice. Since it does not have a “failed” space with payoff as zero, it ends up compounding conversion and stickiness of users and AUM over the long term.

If you face a one-time decision, you want to maximize your arithmetic mean. But with repeated favorable opportunities – either through time or diversification – chances are you will do better in the long term by maximizing geometric mean.

Michael Mauboussin

Is leverage (borrowed time) leading you to arithmetic mean?

When it comes to allocation of money in a portfolio, a discussion on the same is incomplete without considering leverage (borrowed money). Similarly, when it comes to allocating budgets on a portfolio of digital use cases / digital interfaces; the discussion is incomplete without considering leverage (borrowed time). With a traditional approach to digital experiences powered by non standardized systems, an AMC today is living on borrowed time. Our experience has taught us that in managing money digitally, user trust is sacred. And even if a single point of breakage / friction occurs in the user’s digital experience, the user will permanently shift from the active bucket towards the inactive bucket.

Today’s fintechs & new age AMCs have both – a user first & tech first approach since day one. The mindset to enable frictionless investments is just beginning in the MF industry. While one or two apps delivered by service vendors will most certainly achieve the arithmetic mean of an AMC’s digital presence, it will add a failed space to the wheel of digital fortune. Even if there are thousands of spaces (use cases / interfaces / digital touch points) on the wheel of digital fortune and only one failed space, the long term payoff of running a portfolio of use cases by maximizing the arithmetic mean via leveraged time would result in lost trust -> lost users -> lost AUM.

With the API middleware in place, can the geometric mean be maximized?

A formula for maximizing the geometric mean was developed by Bell Labs’ scientist John L. Kelly, Jr. It stipulated that a rational game should have a percentage of their investments allocated into a given use case based on the formula Edge/Odds. This formula has been called the “Kelly Criterion.”

Let’s take the example of a pilot we have been running & seeing interesting results with. With a standardized API middleware in place & powering 100’s of crores in investments, we observed that high payment errors in the checkout part of the transaction flow were leading to poor conversion ratios. With multiple payment gateways available out of the box, we enabled a second one within hours. More importantly, basis our inhouse algo within the API middleware, we were able to dynamically track & initiate the relevant PG depending on the user’s inputs. This reduction in payment gateway errors led to a lift in conversion in the basket (cart based) checkout flow. (Note – This is currently being run as a closed pilot and is not offered to any customer as a full fledged service).

As can be observed in the above example and through various use cases our APIs power, one can obviously not know the edge and odds of each use case upfront with certainty. However, as the range of possible failures reduces via the API middleware, an AMC can allocate more time, effort & budget towards stickiness of the end users (edge). Thereby improving engagement / conversion / retention KPIs, & subsequently improving the digital geometric mean.

How our API middleware targets the geometric mean?

Our goal at Fintech Primitives is to help maximize the AMCs long term returns on digital investments with non zero payoffs (ie, no permanent loss of budgets, efforts or time). Our 10+ years of building various fintech apps helped us realize that the right way to do the same is by standardizing the base features into an API first middleware. The implications of the same being –

- From 18-24 months to 2-3 weeks – Firstly, the middleware aggregates a huge library of integrations, available out of the box. This reduces the time to market for any interface or use case drastically.

- Business logic is a few hours away – Secondly, it handles the entire critical business logic like systematic transaction management, which completely eliminates the need of building a separate backend for every interface or use case. Enabling tactical asset allocation via parameters in a custom rule engine, powering different forms of systematic plans, enabling a new regulatory change is just a few hours away.

- Focus on the thing that matters – Thirdly, with simple to use APIs, it helps the digital team focus only on one thing – the end user (investors / partners / sales / marketing / analysts / etc). By reducing the range of possible failures via the API middleware, AMCs can directly focus on increasing their edge (differentiation, experience, use cases, etc).

- Flexibility – Not happy with one of the underlying third party systems? The huge library of integrations makes it easy to switch from one to the other with zero downtimes.

- Balance between domain & tech – The right depth of domain expertise coupled with simple APIs can work magic in the digital universe.

- Data driven experimentation at scale – With clean transformed data, digital teams can easily build segments and target cohorts as and when needed.

What is your choice – the red pill or the blue pill?

The API middleware is the appropriate starting point of an AMC’s digital journey. It powers the allocation of limited budgets and time in the most efficient way. That is, helps allocate to potential interfaces and/or use cases with the highest chance of outsized returns while minimizing real risk (losing user trust & subsequently high churn). The result is the maximization of the AMCs geometric mean, instead of the arithmetic mean. Thereby transforming a traditional AMC into a fintech.

You take the red pill, you choose Fintech Primitives, & I show you how deep the digital AMC rabbit hole goes…

References

- Powering new age AMCs like Navi

- Enabling digital transformation of large AMC’s like Principal India

- Powering various new use cases

- Fortune’s Formula – Link

- A new interpretation of the information rate, by J. L. Kelly, Jr. –Link

- Size matters, by Michael Mauboussin – Link

- The Matrix trilogy – Link

Product Mgmt & GTM Strategy.

Helping digitize financial infrastructure for wealth mgmt in India