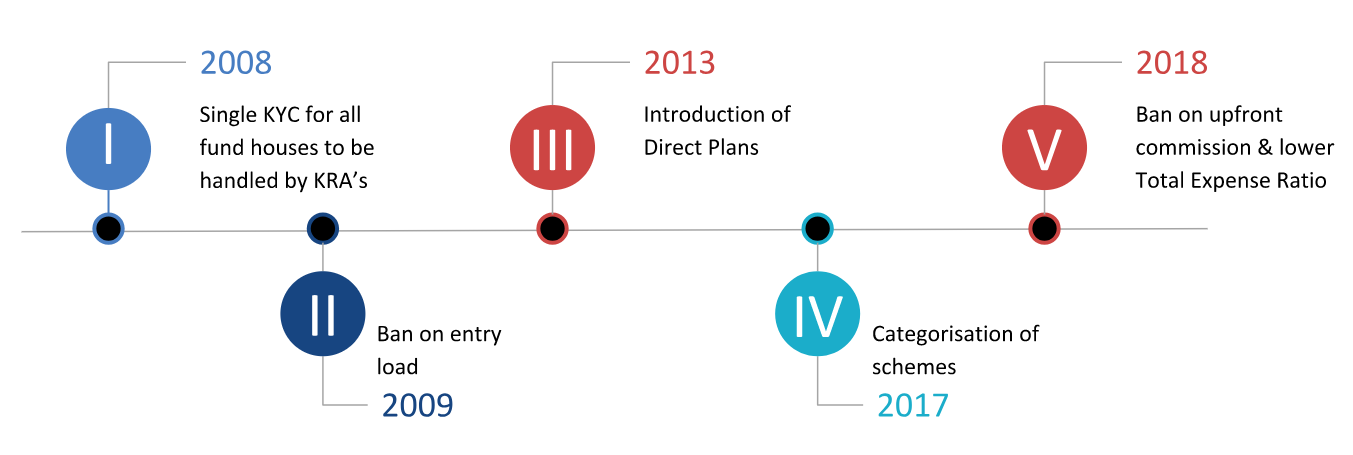

Let’s take a look at a very brief history of mutual funds –

If you are reading this as a distributor or a registered advisor or someone looking to kickstart their journey into the mutual fund business, you would NOT have perceived the above historical changes to have a 60-90% probability of reducing your business margins. However, these changes had always been coming especially since SEBI begun rolling out regulations with the retail investor in mind.

Cognitive Biases

Cognitive bias is a systematic error of perception within one’s environment. Our environment shapes our observations, the data we absorb from it and the insights we try to derive from it. Which is how different biases seep into our minds and distort our realities.

The inability to foresee these industry changes and assuming that the industry will continue to operate as is, is a cognitive bias respectively.

Sounds fascinating, but how is it killing my margins?

Confirmation Biases

We shall take a look at confirmation biases from the mutual funds domain perspective.

Definition The tendency to only listen to information that confirms one’s preconceptions, which makes it difficult to have a fresh view. Or in some cases, a meaningful conversation.

Application to Mutual Funds They are as follows –

Bias 1 – The above changes will increase entry barriers for new distributors to get into the industry

Our take –

-

- SEBI’s focus over the last decade has been the retail investor

-

- A recent analyst report released an astounding figure of ~98% of the Indian population still being untapped.

-

- New investors are comfortable with digital investments and are open to advise through robo-advisors as well as a combination of offline advice + online investment.

- A few distributors cannot capture the entire ~98% population, especially in the present scenario of poor infrastructure, legacy software solutions, and lack of platforms that can enable an easier entry into financial products like mutual funds. Instead, the industry continues to rely on poorly architected technology systems that pitch themselves as platforms but under the hood are legacy order management systems.

Bias 2 – Economies of scale is with AMCs as they control the expense ratios and other costs.

Our take – Economies of scale lies with distributors and advisors, as they are the ones in touch with the customer.

Bias 3 – AMCs will continue with the existing rewards for distributors

Our take – AMC reward programs for distributors will also undergo changes based on incremental AUM instead of net assets, falling in line with full trail commissions. Thereby propelling a focus on bottom lines instead of commission based top lines. This again pinpoints to focusing on better investor experience in order to increase AUM and create a win-win situation for all.

Industry speak –

Mr. A. Balasubramanian, the CEO of Aditya Birla Sun Life AMC Limited and Chairman of AMFI mentioned in an event that SEBI has been slowly moving the needle from the manufacturer to the distributor to the investor respectively.

Bandwagon Bias

We shall take a look at confirmation biases from the technology perspective.

Definition The probability of a person adopting a belief increases in direct correlation with the number of people who hold the belief. It is a powerful form of group thinking. Also referred to as herd mentality.

Application to Mutual Funds The tendency to use legacy order management systems.

Our take – Ask yourself the following questions –

Q – Do I specialise in platforms?

Why would you want to spend the time, energy, and labor necessary to manage a team of platform techies when APIs are already providing great turn-key functionality to your business? Also, why would you spend energy on this effort when your focus is on figuring out market movements and advising your customers.

Q – What level of control do we need on our software system?

At any level of business operations regularly used by organizations, the best way to maintain control and security will actually be to outsource to a platform built by domain experts who understand how to secure a platform in today’s VUCA (volatile/ uncertain/complex/ambiguous) universe.

Q – Who are our customers?

Comfortable not just tracking investments online, but also making payments online.

Q – How much money do we want to spend on building a platform?

Rather than focusing on managing hardware (cloud-based computing) or building your own in-house platform, you can focus your investments on building out new use cases purchasing an intuitive platform to host your customer-facing application and let the platform manage the underlying complexities.

A pay as you use platform is the most suited for such offerings.

Q – How much time do I want to spend on deploying the platform?

It takes time to design and ship any platform which is solving diverse complexities into API’s. The better question to ask is – how much time do you want to spend building the foundation of your software rather than actually building your customer-facing application?

A large fintech player spent a sizeable 18 months building inhouse infrastructure. Do you want to spend time building this or solving investment related problems for your investors?

Q – What does success mean to me?

Success means focusing on relationship management, advisory efforts and other acquisition and conversion related problem statements. While the platform helps you scale through near zero transaction costs.

Industry speak –

To quote Mr. Suraj Kaeley, President – Sales & Marketing at UTI Mutual Fund,

It is crucial to create a low cost model or bare bone business model targeted at cost conscious investors. Leveraging technology and/or platforms are an absolute must in today’s day and age. The margins would drop and building volumes would be crucial. Fixed income products coupled with technology could serve as an ideal tool to build the core business for the distributor / IFA.

Survivorship bias

We shall take a look at confirmation biases from the build vs buy perspective.

Definition – Errors that come by focusing only on survival, causing misjudgment of a situation. And avoidance of the long-term market scenario.

What is the bias?

- Build our own instead of subscribing to a platform. This can take almost 18 months while a fintech still cannot go live.

- Use a product that only handles basic transactions management and figure out the rest when users complain or worse still, when users drop out of your application.

Our take –

Ask yourself the following questions –

- Are you only interested in doing this business for the next 1-3 years

- Are you deeply aware about what your end user (the investor) is looking for?

- Do you wish to serve your users through new use cases?

- What if you could use the same backend infrastructure, the same APIs to build different experiences and enable new use cases

In order to answer the above, we would suggest you ask a different set of questions to a platform offering –

- Is the platform built by an experienced team of product and engineering professionals? Has the team served any other key companies in the mutual fund/finance industry?

- Is the platform team focused on their own profit margins or on solving my problem of serving investors better?

- Are the APIs friendly, that is, are they robust, RESTful based that any small development team can begin using?

- Is the platform capable of handling more than 1 lakh transactions a day?

- Does the platform have unnecessary costs or does it offer me the flexibility to choose whatever I need for my business in my current situation?

- Has the platform failed at any time?

- How soon can I get started on using the APIs? Does it require some complex setup to be initiated for my development team?

- Can I close my development in three weeks? That is, can I start offering my application to customers in 3 weeks?

- Do I have the flexibility to use my own technology team or hire any development agency I deem fit a? And can I build my customer facing application using any programming language/technology stack?

- Do my investors get insights into their portfolios through capital gains, XIRR, etc?

- Do I get insights into my business through MIS reports without the headache of calculating them on a daily basis?

- Am I restricted by the platform or can I use my own creativity to come up with an awesome customer experience for my investors?

Summary

There are close to 20 identified cognitive biases which the human mind has to deal with. It takes vision, first principles thinking and customer centricity to overcome the same. This effort for Fintech Primitives has translated into reducing the entry barriers for creating a fintech business. As an example, our mutual funds APIs are the simplest in the industry. Which is why the top fintech businesses are happy to integrate with our APIs, experiment with new use cases and serve the untapped ~98% Indian population. The only way to overcome the above biases is to ask yourself the above questions. And hopefully, they shall help you figure out the right path not just for your technology / platform choice, but also your distribution business and your customers respectively.

References

- 8+ years of experience building the top robo advisors in India like Scripbox, Clearfunds (acquired by Mobikwik), etc.

- Experience of building global insurance and lending platforms

- Conversations with multiple online and offline distributors

- Forbes cloud columns

- Cafe mutual columns

- Economic Times columns

- Various analyst reports

- https://blog.containership.io/

- https://invertedpassion.com/cognitive-biases-poorly-designed-products/

- Cafe Mutual Column

- Perceptions of probability

Product Mgmt & GTM Strategy.

Helping digitize financial infrastructure for wealth mgmt in India