SEBI’s sweeping transformations with its regulations keeping the retail investor in mind has spurred some of the largest distributors, advisors, and AMCs to rethink their approach towards the end customer. Yet, ~98% of the retail population is yet to be brought into the fold of the mutual fund industry. And ₹ 35,000 crores still reside in the savings account of banks instead of liquid and debt funds.

This massive opportunity to bring these investors onboard through not just SIPs but true micro investing begins with technology. Traditionally, the finance industry has been running on mainframes. Then came the surge of web applications and mobile applications which were based on client/server architectures. However, to take true advantage of technology, what fintech businesses need is the ability to serve customers at scale and the ability to draw insights through their data with intelligent systems. The precursor to these benefits is moving to the cloud and taking a platform-centric approach respectively.

The genesis of an API Platform

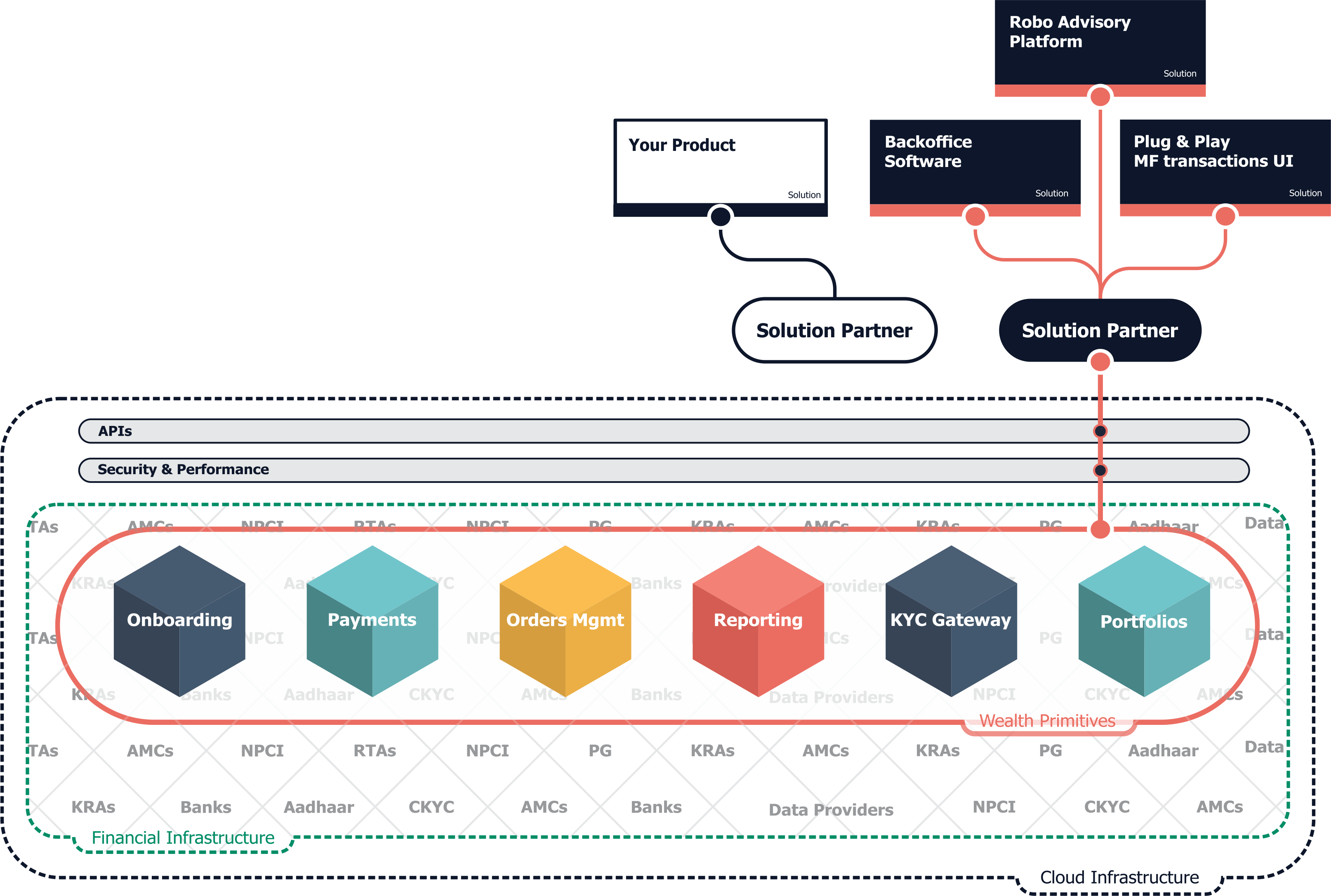

In general, platforms are driven by four key factors:

- Building blocks, which move towards solving all problems over the cloud, unlike traditional systems that offer only order management.

- Core business model, which precludes the platform from competing with its customers.

- Trust factor that ranges across not only an increasingly open source technology approach but also business policies stating that the data created by the business customers is the property of those business customers, and not of the platform.

- An end-to-end approach of digital technologies that allow customers to transition seamlessly from on-premises technology to the cloud, quickly automate key functions across the organization and enable an agile movement into entering new verticals.

The need for a mutual fund platform arose as a result of a multitude of factors that have converged towards the end customer. This has mandated the need for any mutual fund organization to convert into an investor-centric organization. Subsequently, this can happen only by undertaking a shift towards becoming a digital business which requires technology to infiltrate across the organization. Thereby, the platform makes itself indispensable to the organization’s ability to compete, to grow, and to create new value for customers.

So, what does a helpful MF platform look like?

The trust dimension

- Who owns the data? – A helpful MF platform will maintain a clear legal status about the data belonging to the customer. While the platform’s IP and innovation are extended to all the companies as they move along the journey of digitising their businesses, the ownership of data remains with the business consuming the APIs. This is huge in terms of launching a new fintech business especially in complex regulated markets like Indian mutual funds, and finance in general. In addition, a healthy sign is of the product and engineering teams actively engaged with the customer’s employees to help them navigate through with a list of things like integrations, data privacy, security and so on and so forth.

- Your margin is NOT my opportunity – Be it the mutual fund houses or the distributors/advisors, each stakeholder should take comfort that the platform is not interested in eating into their hard-earned margins, going vertical to enter the business as their competition or bullying them into higher pricing.

The business dimension

- Investor centric – A true MF platform has features that any B2C distributor would want to offer to his/her investors.

To quote Mr. Suraj Kaeley, President – Sales & Marketing at UTI Mutual Fund,

“The new generations of investors largely look forward to digital mode of transactions. A digital strategy built around enhanced used of technology can fit well into ever changing environment.

We believe retail fund distribution is undergoing a structural change. Opportunities are plentiful and distributors need to provide a comprehensive solution catalogue in alignment with the needs of customers. A customer centric approach, technology enabled service capability, a healthy mix of customer types and a diversified product range is the way to achieve success for the new age distributor/advisor”.

- Time to market – While a large fintech player took a sizeable 18 months to build the entire mutual funds backend infrastructure in house and go live, Fintech Primitives promises an integration time of less than 4 weeks. This has been possible because of the deep integrations with 50+ partners behind the scenes. This enables companies to launch and experiment faster. Eg – a lending company wanting to diversify its offerings can integrate the APIs in less than a month, run a pilot with 20% of their user base and scale the respective use case if it benefits their end users.

- Near zero transaction costs – While any platform is typically perceived as a manufactured product with COGS (cost of goods sold), a helpful API only platform instead focuses on transforming the business of its customers. This customer centric approach gives way to efficiency at scale. Each API would be designed by marrying B2C and B2B perspectives. A platform will have all of this come together to provide a true API only offering for mutual fund distributors. This turns into an advantage in terms of COGS. The ability of a platform to operate at low prices then becomes a function of the platform services that are being offered, instead of a race to the bottom with free (but poor) solutions.

The technology dimension

- Building Blocks – A platform that believes that adoption of financial products like mutual funds is an engineering problem statement, and not a financial problem statement will be key to larger distribution in India. The platform should continuously seek out composable abstractions that enable flexible, standardized, scalable integrations. And since it removes the unnecessary complexity, one should be able to get up and running in a matter of minutes

- Security – The security layer built as a part of SEBI recommendations and regularly evaluated by government regulatory bodies helps customers quickly become compliant with whatever new security, data privacy and regulatory concerns they could be faced with. And if customers choose to enter enable new use cases, the flexibility that comes with already being compliant acts as a huge shortcut for time to market.

- Scale – A platform processing assets worth ₹ 300,00,00,000 + in just a few months is a leading indicator of the ability to handle large volumes. A helpful platform would have taken into consideration various technology tradeoffs to be built from the ground up with scale in mind.

Summary

Businesses who have made the monumental mental shift from being just a distributor to a fintech player are integrating with the only full-featured platform available in the market. Yet, the bullish part of the story is that mutual fund companies are still in the opening chapters of the mutual fund book. With less than 2% of the Indian population invested, there are a variety of use cases which can be used to acquire, convert and retain end users. However, the true potential of these use cases can only be realised when the most investor-centric platform helps not just fintech businesses through dev-friendly APIs, but also helps serve the end users through meaningful APIs.

References

- 10+ years of experience building the top robo advisors in India like Scripbox, Clearfunds (acquired by Mobikwik), etc.

- Experience of building global insurance and lending platforms

- Conversations with multiple online and offline distributors

- Forbes cloud columns

- Cafe mutual columns

- Economic Times columns

Product Mgmt & GTM Strategy.

Helping digitize financial infrastructure for wealth mgmt in India