The following are our perspectives on the 7 point agenda laid down by the BCG report recently published by AMFI respectively.

Reference – BCG report

1) Nurture and invest in new customers

The report does not seem to have incorporated feedback from the likes of Scripbox, WealthApp, Kuvera and other digital first players who saw this coming many years back and have been striving all along in that direction.

At Cybrilla, we have been engineers at heart. Working since 9+ years with forward looking fintech companies helped us see the digital inflection point before anyone else. This lead to the creation of Fintech Primitives (the API platform for wealth management) from the ground up.

2) Shift gears to accelerate distribution outreach

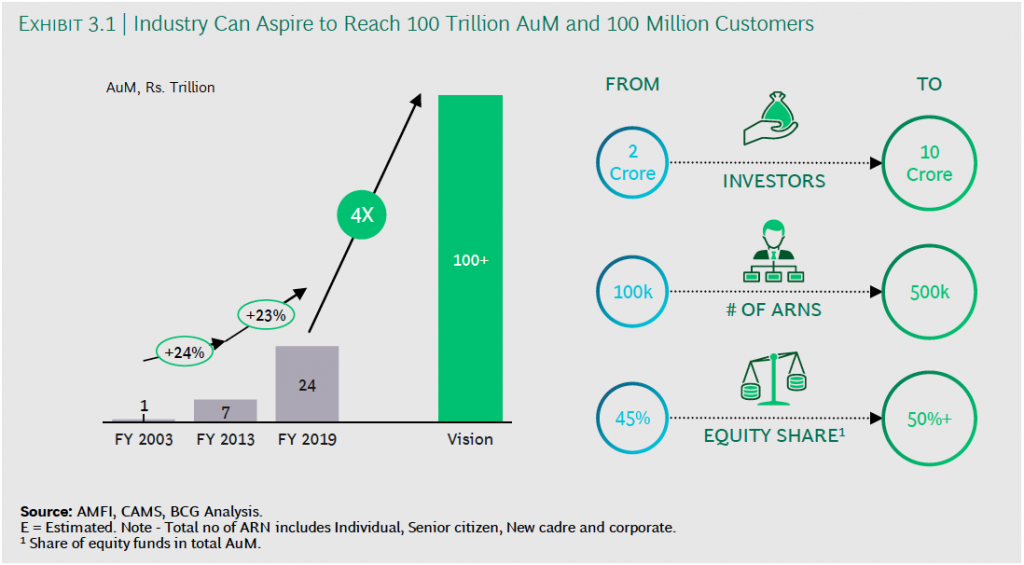

The report takes a very peripheral approach but mentions nothing about the multiple hurdles that an entity (individual or corporate) has to cross to even begin distributing mutual funds. Fintech Primitives has solved multiple moving parts into a standardised API platform, & continues to work with a customer first approach towards ARN and RIA holders. The industry can grow 5x from 100K to 500K distributors when well engineered APIs enable & empower distribution.

Source:BCG report

3) Reimagine core customer experience

Having built multiple fintech apps across verticals, including the top robo advisors like Scripbox, WealthApp & Clearfunds from scratch, we realised that the end user experience gets severely impacted by broken backend infrastructure.

It takes anywhere between 18-24 months for a digital distributor / robo advisor to go live. This is why we came up with an API first strategy. APIs allow instant experimentation, control over user experience, 23x less costs, & a time to market of 1 month respectively.

Reference – Build vs Buy: Build fintech apps from scratch or launch with APIs

4) Exploit technology across the value chain

Peel the layers behind jargons like digital transformation, AI/ML, etc & one realises that APIs are at the heart of any industry. APIs need to be well engineered and properly thought through to support scale, new use cases, enablement of distribution & other innovations.

References –

- Developer platform for financial use cases

- I got a golden ticket: What I learned about APIs in my first year at Google

5)Leverage partnerships to expand capabilities

Fintech Primitives has 50+ partners and is adding more to provide a standardised offering to existing and new players.

Reference – Partners

6)Awaken industry to self-governance

It is easy to throw AI/ML as a solution to anything. However, the right problem needs to be solved first. Which is where we are building the right technology infrastructure first. Advanced solutions, automation, AI/ML can kick in on top of the base layer, as and when required. Note – Data science is more applicable than buzzwords like deep learning, ML or AI.

Reference – Modern apps at AWS

7) Continued regulatory oversight and support

The platform has been structured into building blocks, so that any regulatory changes for a specific use case can be instantly incorporated and available for distributors. Eg – a new KYC regulation does not impact the entire backend infrastructure. It can be quickly added into the specific building block/module for distributors to acquire new users instantly. In the current systems, such processes are not only broken, but also take months of effort to ship the feature to distributors and advisors.

References –

- Traditional platforms vs Fintech Primitives APIs

- Robo advisor killer: The cost of acquiring customers

Product Mgmt & GTM Strategy.

Helping digitize financial infrastructure for wealth mgmt in India